Amazon is a global technology leader in online retail and cloud computing. Amazon businesses encompass a large variety of product types, service offerings, and delivery channels. Amazon primary customer sets consist of consumers, sellers, developers, enterprises, and content creators.

- Amazon serve consumers through its retail websites and physical stores. Amazon also manufactures electronic devices and sells them to consumers.

- Amazon offer programs that enable sellers to sell their products on its websites and their own branded websites and to fulfill orders through Amazon.

- Amazon serve developers and enterprises of all sizes through AWS segment, which offers a broad set of global compute, storage, database, and other service offerings.

- Amazon offers programs that allow authors, musicians, filmmakers, app developers, and others to publish and sell content.

Amazon makes money primarily by selling consumer products and subscriptions through its North America and International websites. In addition, Amazon sells cloud services for on-demand delivery of IT resources and applications via Internet.

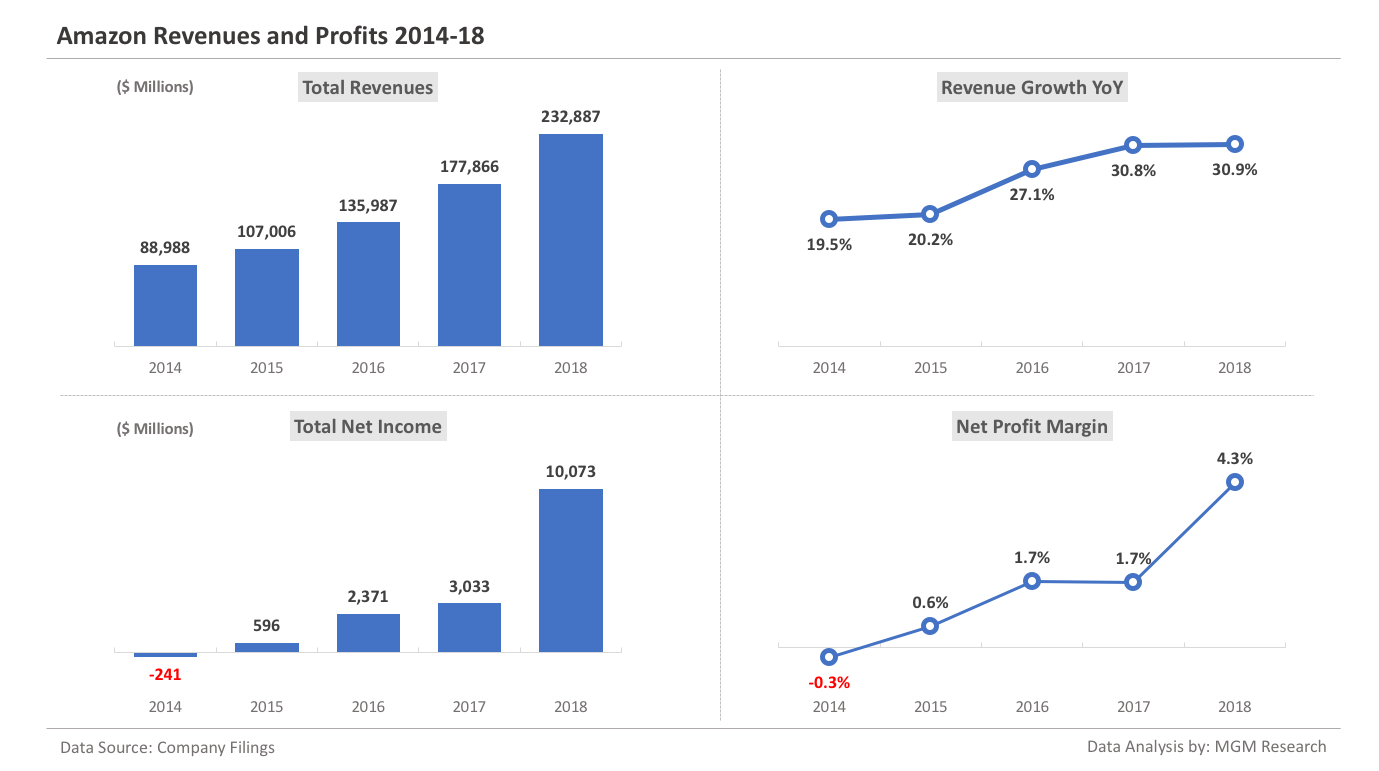

Amazon Revenues and Profits 2014-18

Amazon generated $233 billion of revenues during 2018, up 31% yoy, from $178 billion in 2017. Amazon reported a net income of $10 billion during 2018 and the net profit margin was 4.3%. The diagram below provides the charts for Amazon revenues, revenue growth, net income, and net profit margins for the past five years.

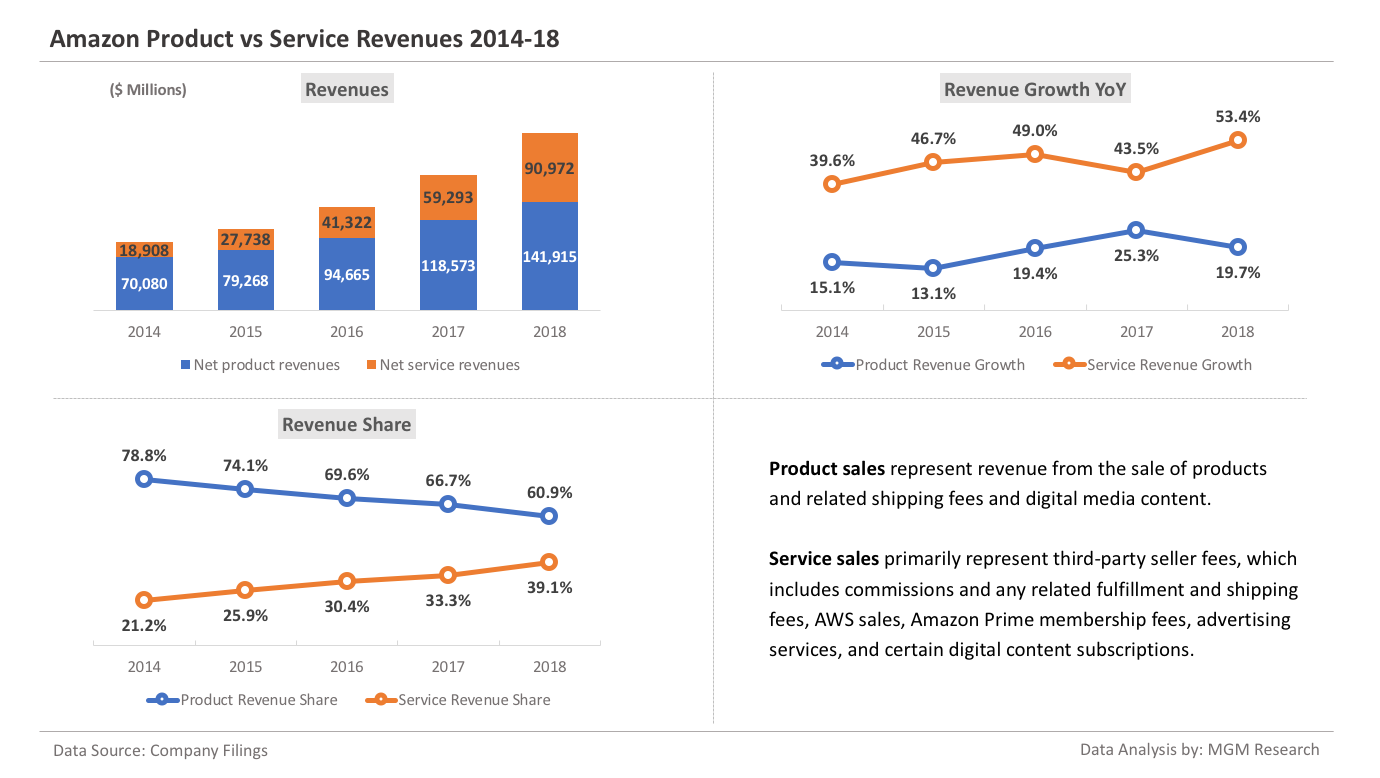

Amazon Product vs Service Revenues 2014-18

Of the $233 billion of total revenues in 2018, Amazon generated $142 billion of product sales and $91 billion from services sales.

Product sales represent revenue from the sale of products and related shipping fees and digital media content.

Service sales primarily represent third-party seller fees, which includes commissions and any related fulfillment and shipping fees, AWS sales, Amazon Prime membership fees, advertising services, and certain digital content subscriptions.

The diagram below provides the charts for Amazon product and services revenues, revenue growth, and revenue share. The product revenue share continues to decline and the services revenue share continues to increase. The services revenue continue to grow much faster than the product revenues.

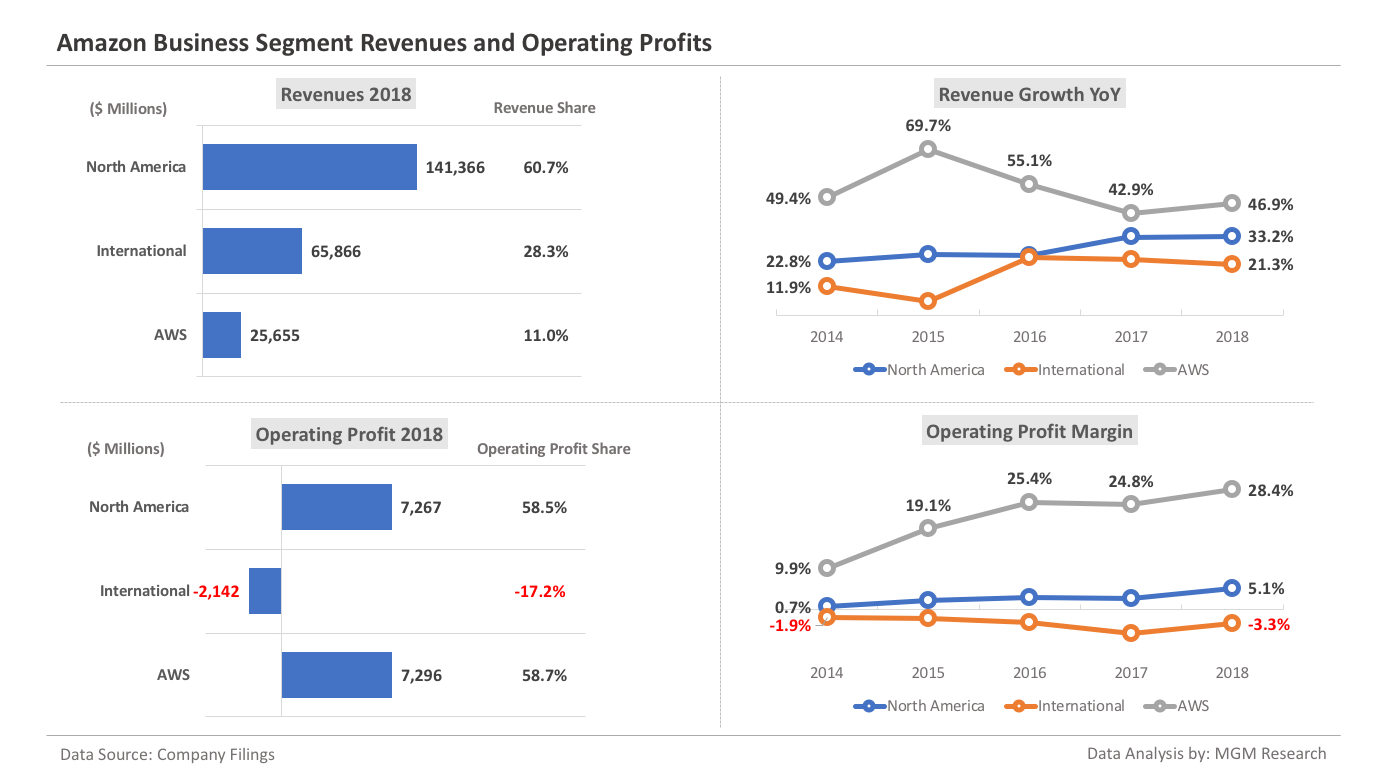

Amazon 2018 Revenues and Profits by Business Segments

Amazon reports its revenues for the following business segments: North America, International, and AWS. Here is a brief description of these business segments:

The North America segment consists primarily of amounts earned from retail sales of consumer products (including from sellers) and subscriptions through North America-focused websites such as http://www.amazon.com, http://www.amazon.ca, and http://www.amazon.com.mx. This segment includes export sales from these websites.

The International segment consists primarily of amounts earned from retail sales of consumer products (including from sellers) and subscriptions through internationally-focused websites such as http://www.amazon.com.au, http://www.amazon.com.br, http://www.amazon.cn, http://www.amazon.fr, http://www.amazon.de, http://www.amazon.in, http://www.amazon.it, http://www.amazon.co.jp, http://www.amazon.nl, http://www.amazon.es, and http://www.amazon.co.uk. This segment includes export sales from these internationally-focused websites (including export sales from these sites to customers in the U.S., Mexico, and Canada), but excludes export sales from North American websites.

The Amazon Web Services (AWS) segment consists of amounts earned from global sales of compute, storage, database, and other AWS service offerings for start-ups, enterprises, government agencies, and academic institutions.

Amazon Business Segments Revenues 2018

Of the $233 billion of total net sales in 2018, Amazon generated:

- $141 billion, 61% of the total, from the North America segment;

- $66 billion, 28% of the total, from the International segment; and

- $26 billion, 11% of the total, from the Amazon Web Services (AWS) segment.

Amazon Business Segments Operating Profits 2018

The operating income and operating margin of the Amazon business segments during 2018 is provided as follows:

- North America segment had a segment operating income of $7.3 billion and a segment operating margin of 5.1%;

- International segment had a segment operating income of -$2.2 billion and a segment operating margin of -3.3%; and

- AWS segment had a segment operating income of $7.3 billion and a segment operating margin of 28.4%.

The diagram below provides the charts for Amazon business segments revenues, revenue growth, operating profit, and operating profit margins. The AWS segment continues to grow much faster than the company. AWS segment operating profit margins also continue to increase and are much higher than the company overall operating profit.

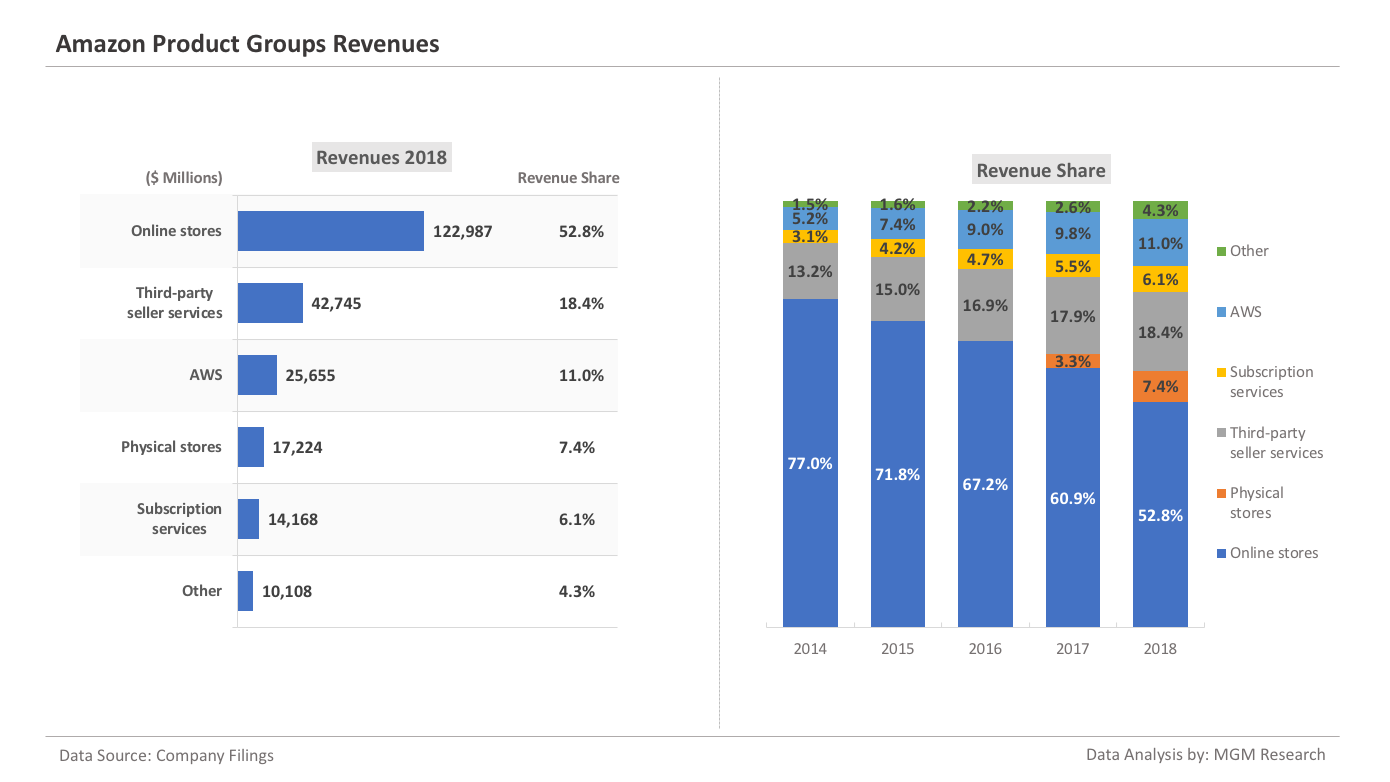

Amazon Product Groups Revenue 2018

Amazon reports revenues as per the following product groups: Online stores, Physical stores, Third-party seller services, Subscription services, AWS, Other

Online Stores. It includes product sales and digital media content sold on a transaction basis. Amazon offers a wide selection of consumable and durable goods that includes electronics and general merchandise as well as media products available in both a physical and digital format, such as books, music, video, games, and software.

Physical stores. It includes product sales where customers physically select items in a store. Amazon acquired Whole Foods Market, a grocery store chain, on August 28, 2017, for approximately $13.2 billion, net of cash. Amazon is also experimenting with physical stores (known as Amazon Go) that allow customers to purchase products without using a cashier or checkout station.

Third-party seller services. It includes commissions, related fulfillment and shipping fees, and other third-party seller services.

Subscription services. It includes annual and monthly fees associated with Amazon Prime membership, as well as audiobook, e-book, digital video, digital music, and other subscription services.

AWS. It refers to Amazon Web Services segment.

Other. It includes sales not otherwise included above, such as certain advertising services and Amazon co-branded credit card agreements.

Of the $233 billion of net sales in 2018, Amazon generated:

- $123 billion, 52.8% of the total, from online stores;

- $43 billion, 18.4% of the total, from third-party seller services;

- $26 billion, 11.0% of the total, from AWS;

- $17 billion, 7.4% of the total, from physical stores;

- $14 billion, 6.1% of the total, from subscription services; and

- $10 billion, 4.3% of the total, from Other.

The diagram below provides the charts for Amazon product groups revenues and revenue share. The revenue share of online stores continue to decline, whereas the revenue share of all the other product groups continue to increase.

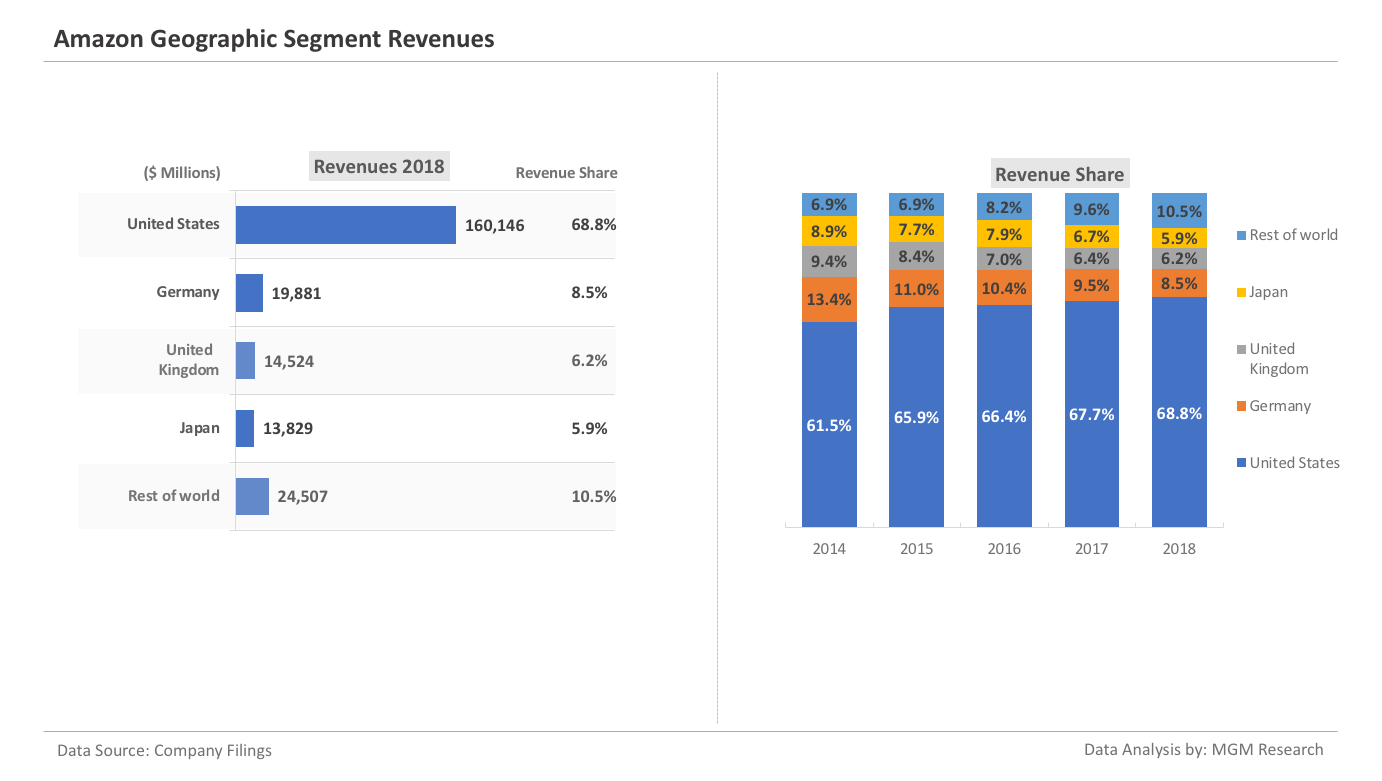

Amazon 2018 Net Sales by Country

Of the $233 billion of net sales in 2018, Amazon generated:

- $160 billion, 68.8% of the total, from the United States;

- $20 billion, 8.5% of the total, from Germany;

- $15 billion, 6.2% of the total, from the United Kingdom;

- $14 billion, 5.9% of the total, from Japan; and

- $25 billion, 10.5% of the total, from Rest of the World.

The diagram below provides the charts for Amazon geographic segment revenues and revenue share. The revenue share of Germany, the UK, and Japan continue to decline, whereas the revenue share of the US and rest of the world continue to increase.

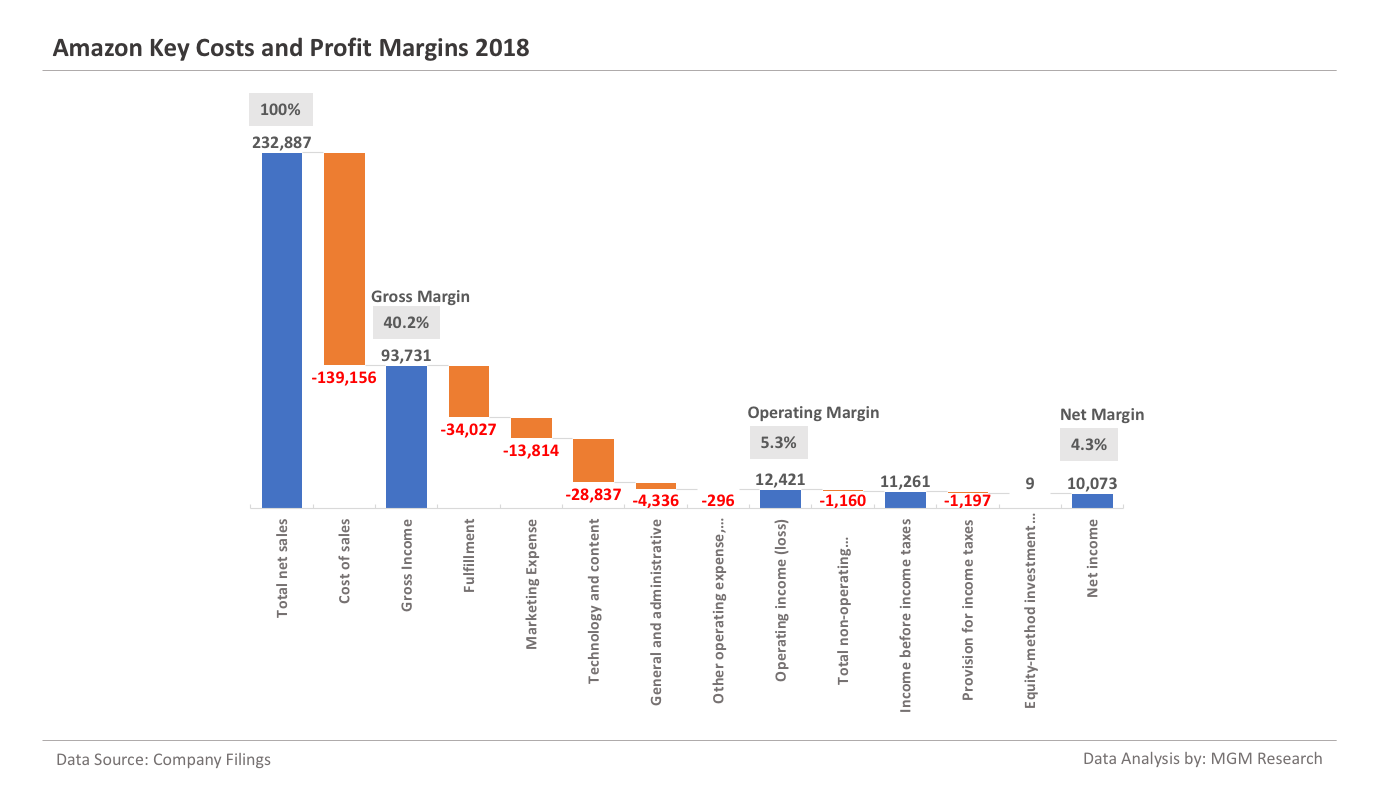

Amazon Key Costs and Profit Margins 2018

Amazon generated $233 billion of total net sales in 2018.

Amazon key costs include cost of sales, fulfillment costs, marketing costs, technology & content costs, and general and administrative expenses.

Amazon Cost of Sales during 2018 were $139 billion. Cost of sales primarily consists of the purchase price of consumer products, digital media content costs, including Prime Video and Prime Music, packaging supplies, sortation and delivery centers and related equipment costs, and inbound and outbound shipping costs, including where Amazon is the transportation service provider.

In 2018, Amazon gross profit was $94 billion and Amazon gross profit margin was 40.2%.

Amazon Fulfillment costs during 2018 were $34 billion. Fulfillment costs primarily consist of those costs incurred in operating and staffing North America and International fulfillment and customer service centers and physical stores, including costs attributable to buying, receiving, inspecting, and warehousing inventories; picking, packaging, and preparing customer orders for shipment; payment processing and related transaction costs.

Amazon Marketing costs during 2018 were $14 billion. Marketing costs primarily consists of spend on a number of targeted online marketing channels, such as Amazon Associates program, sponsored search, portal advertising, email marketing campaigns, direct sales, and other initiatives.

Amazon Technology and Content costs during 2018 were $29 billion. Technology costs consist principally of research and development activities including payroll and related expenses for employees involved in application, production, maintenance, operation, and platform development for new and existing products and services, as well as AWS and other technology infrastructure expenses. Content costs consist principally of payroll and related expenses for employees involved in category expansion, editorial content, buying, and merchandising selection.

Amazon General and Administrative expenses during 2018 were $4 billion. General and administrative expenses primarily consist of payroll and related expenses; facilities and equipment, such as depreciation expense and rent; professional fees and litigation costs; and other general corporate costs for corporate functions, including accounting, finance, tax, legal, and human resources, among others.

In 2018, Amazon operating profit was $12 billion and operating profit margin was 5.3%.

After interest and other income/expenses and income taxes, Amazon reported a net profit of $10 billion and a net profit margin of 4.3% during 2018.

Amazon key costs and profit margins information is provided in the chart below:

Amazon Competition

Amazon faces a broad array of competitors from many different industry sectors around the world. Amazon current and potential competitors include:

(1) Online, offline, and multichannel retailers, publishers, vendors, distributors, manufacturers, and producers of the products Amazon offer and sell to consumers and businesses.

(2) Publishers, producers, and distributors of physical, digital, and interactive media of all types and all distribution channels.

(3) Web search engines, comparison shopping websites, social networks, web portals, and other online and app-based means of discovering, using, or acquiring goods and services, either directly or in collaboration with other retailers.

(4) Companies that provide e-commerce services, including website development, advertising, fulfillment, customer service, and payment processing.

(5) Companies that provide fulfillment and logistics services for themselves or for third parties, whether online or offline.

(6) Companies that provide information technology services or products, including on-premises or cloud-based infrastructure and other services.

(7) Companies that design, manufacture, market, or sell consumer electronics, telecommunication, and electronic devices.